Forms

- Membership Application

- General Forms

- Employee Related Forms

- Scholarship Forms

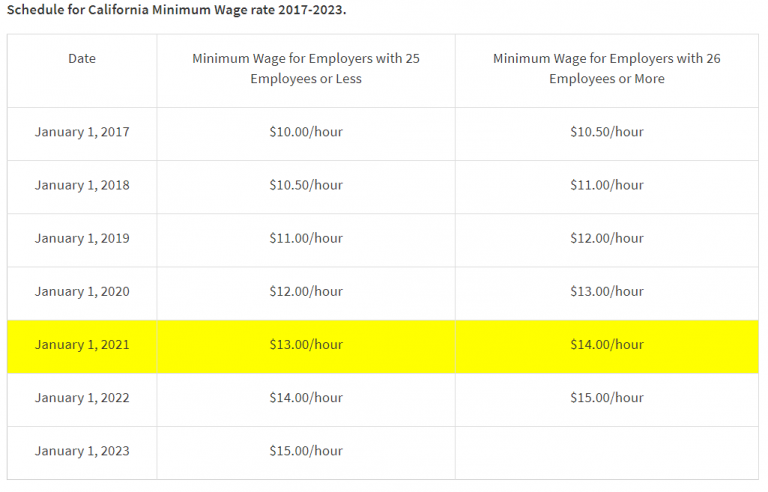

Be sure to abide by California state law regarding paying your employees minimum wage.

Frequently Asked Questions

1. What is the minimum wage?

Effective January 1, 2021, the minimum wage increases to $14 per hour for employers with 26 or more employees and $13 per hour for employees with 25 or fewer employees. The minimum wage shall be adjusted on a yearly basis through 2023 according to the pre-set schedule shown above.

2. What is the difference between the local, state and federal minimum wage?

Most employers in California are subject to both the federal and state minimum wage laws. Also, local entities (cities and counties) are allowed to enact minimum wage rates and several cities have recently adopted ordinances which establish a higher minimum wage rate for employees working within their local jurisdiction. The effect of this multiple coverage by different government sources is that when there are conflicting requirements in the laws, the employer must follow the stricter standard; that is, the one that is the most beneficial to the employee.

3. May an employee agree to work for less than the minimum wage?

No. The minimum wage is an obligation of the employer and cannot be waived by any agreement, including collective bargaining agreements. Any remedial legislation written for the protection of employees may not be violated by agreement between the employer and employee.

4. Is the minimum wage the same for both adult and minor employees?

Yes. There is no distinction made between adults and minors when it comes to payment of the minimum wage.